A high profile property management company was recently found to be responsible for a series of fake Facebook and Google reviews. The dishonest act got us thinking about the importance of online reviews and the trust signals they send out. Reviews provide valuable information about a business and even with their inherent subjectivity, online reviews can help people make a decision about whether to do business with a company — and that includes weighing up both positive and negative reviews.

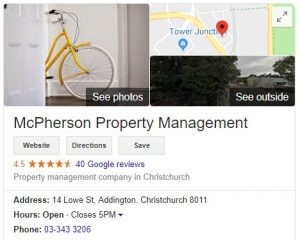

Here at McPherson Property Management we encourage our property owners and our tenants to leave reviews. Many of them are glowing reviews (hence our 4.5 star rating on Google) but occasionally some are not so positive. To us it’s really important that people leave honest reviews about the service they’ve received from us so that prospective clients and tenants can know what to expect. Although we’d love nothing more than to receive only positive reviews, we’re of the opinion that negative reviews help us to address any grievances our clients may have and to improve our overall customer service — and there really is nothing more important to us.

We endeavour to respond to all reviews that we receive — whether they’re left online, via email correspondence or verbally. We get a kick out of positive reviews as it helps us know that we are doing our jobs well. But it’s equally as important to us that people who have left negative reviews know that we take their comments seriously and will always act on any legitimate concerns.

We’d love it if you could leave your review too:

But if you don’t feel comfortable doing this in a publicly visible online setting then please do get in touch with us by email or phone — we’d love to hear from you.